Benefit Basics

PERA is a 401(a) defined benefit plan you pay into while working as a public employee, and offers a lifetime monthly benefit when you retire. Unlike a 401k, your contributions are a set amount, and your monthly benefit is calculated using your years of service, average salary, and age when you start your benefit.

This benefit replaces part of your income in retirement, along with Social Security and personal savings.

Your defined benefit plan offers other benefit options if you are unable to collect a retirement benefit, including,

- Disability monthly benefits if you become disabled before retirement,

- Survivor monthly benefits or a lump-sum payment to beneficiary(ies) if you die before retirement or,

- A refund of your account if you do not have enough service to qualify for a monthly benefit.

Membership

PERA covers Minnesota local government public employees and non-teaching school staff. Membership is required once you meet the earnings threshold, and your earnings exceed $425 in a single month. Once you meet this threshold, your employer will enroll you into your membership group and you will contribute a percentage of each paycheck to PERA.

PERA has three main membership groups. There are exclusions to contributing to defined benefit plans. Specific statutes have exclusions for full-time students under the age of 23, seasonal or temporary employees, independent contractors, and PERA benefit recipients.

Coordinated Members

The largest group, membership includes positions in cities, counties, schools, and other local government entities. PERA “coordinates” with the Social Security Administration and all members pay into Social Security and Medicare. This means that your Social Security benefit should not be offset by your Coordinated pension.

Police & Fire Members

Membership includes full-time police officers and full-time professional firefighters. Part-time positions and certain other public safety positions may also be eligible. Members do not pay into Social Security, but do pay into Medicare.

Correctional Members

Membership includes guards, joint jailer-dispatchers, and protection officers. Most members pay into Social Security and Medicare.

Contributions

Once your PERA membership is established, you will contribute a percentage of each paycheck to your PERA account through payroll deductions. You cannot increase or decrease the amount you contribute, as contribution rates are determined by law, based on your plan and eligible gross salary. Your PERA contributions are tax-deferred, so you will not pay taxes on your contributions now. Once your benefit begins, federal tax and state tax (if applicable) will be owed. Your employer also contributes a percentage, but their contributions are not a match like a 401(k)-style plan.

Employer contributions help fund your plan—their contributions are not included in your account balance and are nonrefundable if you choose to take a refund. They remain with the plan to pay lifetime monthly retirement, survivor, and disability benefits.

The table below provides the current member and employer contribution rates for the three defined benefit plans. Prior contribution rates can be found on our Historical Plan Rates page.

| Member | Employer | |

|---|---|---|

| Coordinated | 6.5% | 7.5% |

| Police & Fire | 11.8% | 17.7% |

| Correctional | 6.83% | 10.25% |

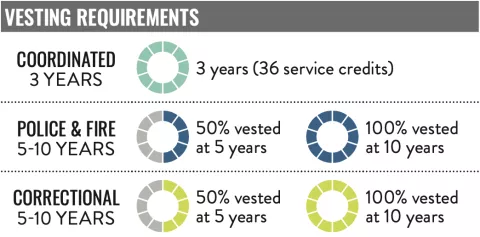

Vesting

One of the objectives of membership is to become vested in your plan. Vesting means you have earned enough service credits to receive a monthly lifetime benefit after leaving public service and reaching a retirement-eligible age. You earn one service credit each month you contribute to your plan. PERA converts your monthly service credits into years and months for vesting and benefit calculation purposes.

If you have contributed to another Minnesota public pension plan, your service in the other plan will be applied to your PERA vesting requirement.

Please note that even if you are vested, you are not eligible for your employer’s contributions to the plan should you end public service and take a refund of your account balance.