Tax withholding and 1099s

Tax Withholding and 1099s

Applying for Benefits

Your PERA benefits are subject to federal taxes and state taxes (based on your residency). We can withhold state taxes for MN residents; if you are a non-MN resident, contact your state for tax withholding requirements. PERA can withhold the default tax amount OR you can complete the federal and/or MN state tax form(s) to withhold a different amount.

Option 1 –Default Tax Withholding/No Tax forms

Starting January 1, 2024: The Minnesota state tax withholding default will change from Single, 0 exemptions to 6.25%. Benefit recipients may complete a W-4MNP to withhold a tax amount other than the new default.

If no tax forms are submitted with your application, PERA will automatically withhold:

-Federal: Single, no adjustments (20% for refunds)

-MN State (MN residents only): 6.25%.

Option 2 – Complete Tax Forms

To withhold a tax amount other than the default, you will need to submit a completed W-4P federal tax form (W-4R for refunds) and/or W-4MNP MN state tax form with your application.

Federal W-4P – use for monthly benefits

Federal W-4R – use for refund

Minnesota W-4MNP (MN residents only) – use for monthly benefits or refund. Complete the periodic payments section if you are applying for monthly benefits from PERA. Complete the nonperiodic distribution section if you are applying for a refund.

After Benefits Begin

For monthly benefit recipients, you may change your taxes at any time on myPERA or by sending PERA updated tax forms.

Tax Resources

PERA cannot provide advice or assistance with tax forms. Consult a tax professional if you have any questions. Several agencies offer tax assistance:

Internal Revenue Service (IRS) – 1.800.829.1040

Minnesota Department of Revenue – 1.800.657.3694 or 651.282.9999

American Association of Retired Persons (AARP) – 1.888.227.7669

Prepare + Prosper – 651.287.0187

Volunteer Income Tax Assistance (VITA) – 1.800.906.9887

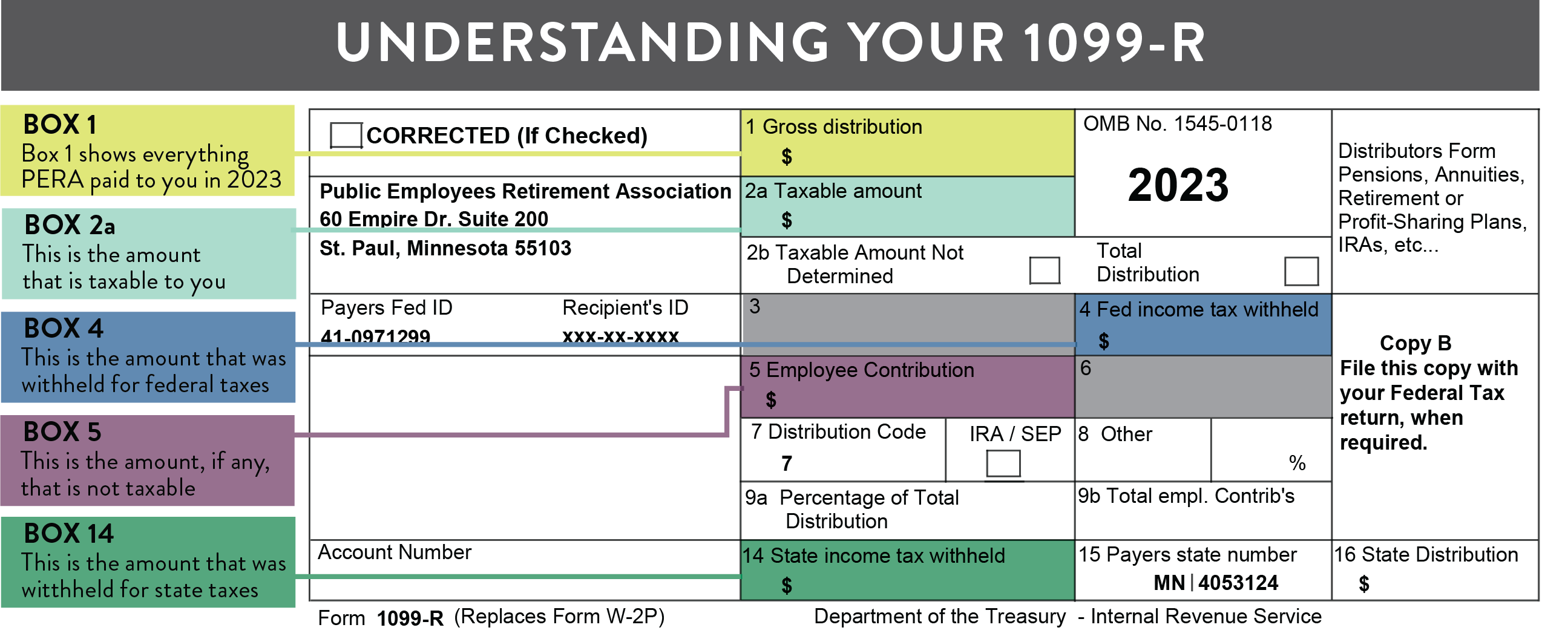

Each year, PERA will mail you Form 1099-R by the end of January to report your income. You can also find it on myPERA by January 2nd each year.

Box 1: The total (Gross) amount you received this year from refunds, direct rollovers, or annuity benefits before taking out any withholdings. This amount is usually reported on IRS Form 1040 on line 5a labeled “Pensions and Annuities.” If the pension is a disability pension and the member has not reached the minimum retirement age, the amount in Box 1 should usually be reported on line 7 labeled “Wages, salaries, tips, etc.”

Box 2a: This box shows the part of the amount in Box 1 that is taxable. This amount is usually entered on line 5b on Form 1040. For a direct rollover, the taxable amount should be zero.

Box 2b: If the distribution was a total distribution that closed out your account, the 2nd box in 2b will be checked.

Box 3: Not used. (Shaded)

Box 4: This is the amount of Federal income tax withheld on the distribution.

Box 5: This box is used for after-tax contributions recovered during the year. The amount is generally determined by subtracting the amount in Box 2a from the amount in Box 1. Typically this amount does not need to be reported on your return.

Box 6: Not used. (Shaded)

Box 7: The code(s) in this box let the IRS know what type of distribution you received. There will be either 1 or 2 codes in Box 7. The Minnesota PERA does not use all the possible codes available. The definition of the codes used by the Minnesota PERA is as follows:

1. Lump sum distribution paid to you before you turned age 59 ½ when none of the exceptions under Distribution Code 2, 3 or 4 apply.

2. Distribution paid to you before you turned 59 ½, but as in the form of a monthly benefit. A “2” is also used for refunds paid after a separation from service in or after the year you reach age 55 (Regular Plan and Correctional Plan) or 50 (P&F Plan). For tax purposes, a “2” distribution code is treated like a “7” (normal distribution).

3. Disability benefit paid to you before you reach retirement age (or 5 years after the disability effective date, whichever is later, in the Correctional Plan and P&F Plan). If you hit normal retirement age during the year (age 65 in Coordinated/Basic/Correctional and age 55 in Police & Fire), you will receive one 1099R that reflects the disability payments (with a distribution code of “3”) and another 1099R reflecting the “retirement” benefits (with a distribution code of “2” or “7”). This code may also be used for some “in-the-line-of-duty” disabilities in the P&F Plan at any age (duty disabilitants with effective dates between 10/16/92 and 6/30/06 and “total and permanent” duty disabilitants with effective dates after 6/30/06 stay on disability for life).

4. Death benefit paid in a lump sum to a member’s beneficiary, estate or trust.

7. Benefit or refund paid in or after the year in which you reach age 59 ½.

8. Deduction In Error (DIE) refunds made directly to you.

G. Direct Rollover to an IRA or to another qualified plan.

Box 8: Not used. (Shaded)

Box 9a: If a total distribution was made to more than one person, the percentage of the total distribution that you received is shown here.

Box 9b: Not used. (Shaded)

Box 14: If Minnesota state income tax was withheld from the distribution, this box will show the amount we withheld. This amount will be reported on Minnesota tax returns on the line labeled “Minnesota withholding.” PERA does not withhold taxes for any state other than Minnesota.

Box 15: PERA’s identification number as assigned by the State of Minnesota, “MN/4053124”. The IRS does not use this ID number, but the State of Minnesota does to identify the payer. It does not refer to which state the income is taxable in, nor does it refer to which state withholding taxes were deducted. It is simply PERA’s ID number for Minnesota’s Department of Revenue.

Box 16: Generally the taxable distribution (Same as Box 2a). If the taxable distribution is 0, however, the amount of the total distribution (Box 1) is entered in Box 16 as required by Minnesota’s Department of Revenue. This information is not used by the IRS. It is used by the State of Minnesota to record the distribution. If a member resides in another state all year, the distribution is not taxable income in Minnesota. The laws of the state where the member resides determine whether or not the distribution is taxable in that state. If a member resided in Minnesota for part of the year, they will claim that portion of income on the M1-NR form.

The 2023 Minnesota Omnibus tax bill provides for a subtraction for certain qualified public pension income, effective for tax years 2023 and later. Recipients or survivors may qualify for a subtraction if all of these apply:

• They earned public pension income.

• They did not earn credit toward Social Security benefits on this income.

• They are ineligible to receive Social Security benefits for the same service.

Generally, this impacts Basic, MERF, and Police & Fire benefit recipients.

PERA cannot provide tax advice or assistance. If you have any questions, please contact your tax professional.