Currently Working

Welcome to PERA

Whether you’re new to public employment, are midway through your career, or are returning to public service, here is an overview of the important benefits and services available to you as a PERA member.

- THE BASICS

- BENEFIT FEATURES

- NEXT STEPS

- WHAT IF…

What is PERA?

Your PERA pension is a 401(a) defined benefit plan you pay into while working as a public employee. You contribute a percentage of your monthly salary to your PERA account through payroll deductions. Your employer also contributes a percentage, which helps fund your plan, not your account.

After you leave public service, if you are vested, you could qualify for a lifetime PERA retirement benefit. Your PERA pension replaces a portion of your salary. The combination of your pension, Social Security, and personal savings will provide you with retirement income.

Unlike a 401(k), your benefit is calculated with a formula taking into account your age, length of service, and salary – not the contributions you have made. The longer you work in public service, the higher your pension benefit will be.

Membership Eligibility

Your employer determines your membership eligibility and enrolls you into PERA. Membership is required for employees whose monthly salary is expected to exceed $425 (some exclusion may apply).

PERA members work in local government from Public and Charter Schools (excludes licensed teachers), Cities, Counties, Correctional Facilities, Public Hospitals, Public Nursing Homes, Townships, many municipalities, special districts, and other local government entities

Contributions

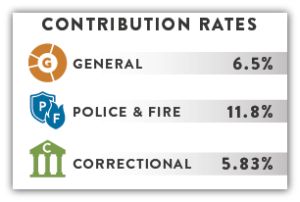

Contributions rates are determined by law, based on your eligible gross salary and are tax-deferred. The percentage is based on the plan you are enrolled in – you cannot increase or decrease the amount you contribute.

The Minnesota State Board of Investment (SBI) manages and invests all contributions on your behalf, making it maintenance-free for you.

Attention Correctional Members: Effective July 1, 2025, contribution rates will increase to 6.83%.

Vesting

Being vested means you qualify for lifetime monthly benefits when you are first eligible to start collecting a monthly benefit. Each PERA Plan has different vesting requirements. See your Plan handbook for more information.

Retirement benefits

Your monthly benefit is based on a formula taking into account your age, length of service, and salary – not the contributions you make. The longer you work in public service, the higher your pension benefit will be.

Factors:

Service Credit

You receive one service credit for each month you work and are compensated by your employer, up to 12 a year.

Age

Full retirement age is 66. Retiring at this age means you will be eligible for your full benefit unreduced for age. However, if you choose to retire early there will be a reduction factor applied to the calculation.

Highest Average Salary

Your five-year average salary (high-five salary) is the gross salary you earn during the 60 consecutive months in which your salary was greatest—not calendar or fiscal years. This could be at the end of your career or it could be in the past. A break in service does not affect this, we ignore that gap.

Disability benefits

You may be eligible for monthly benefits if you become disabled. Qualifications and benefits differ for each plan—see your plan’s handbook for further information.

Survivor benefits

Should you die while working at a PERA employer, PERA may provide monthly survivor benefits to your qualified survivors. State law determines who your qualified survivors are and the order in which they would receive a monthly payment.

Combined Service Annuity (CSA)

If you have service with another Minnesota public pension plan, you may be entitled to a pension from each plan using the same highest average salary. Combined service pensions often provide a higher overall level of retirement income.

Educate yourself

Learn how your PERA benefits factor into your retirement plan. PERA is meant to replace a portion of your income, so we encourage you to educate yourself on other ways to save for retirement. You can read about your specific plan or attend a From Hire to Retire session.

Access myPERA

myPERA lets you view your personal account information and retirement estimates. Activate your myPERA account. You will need your PERA ID to register, which you can find on your welcome letter.

Things to do:

• Name a beneficiary

• Update your personal information

• Review your annual statement

Thinking Ahead

• Do you need help from a financial planner? PERA staff are not financial planners and cannot give financial advice.

• Evaluate your long and short term goals. Have they changed and what do you have to do to accommodate those changes?

• Review your Social Security benefits at ssa.gov

• What income will you have from other retirement accounts?

• Experts estimate you will need 80 to 100% of your pre-retirement income to maintain your standard of living after you retire. Look at your expenses and income today and consider how your cost of living will change based on your retirement goals.

• Review your will, power of attorney, health care directive and other estate planning documents.

While PERA is maintenance free, there may be times when life events can affect your pension.

…I Change Jobs?

If you move to another public or state job, you will continue to contribute to PERA or another public pension. If you are leaving PERA covered employment, you have a few options based on whether you are vested or not. Vesting times are different based on when you started and what plan you’re enrolled in.

Vested

If you are vested when you end public service, your contributions can remain in PERA and you can draw a benefit when you retire.

Not Vested

If you are not vested, you have five years after your last contribution to either return to public service, or take a refund. If you return to public service within five years, you can pick up where you left off.

If you remain out of PERA service, you should apply for a refund, or roll over your contributions into another tax- qualified retirement plan. If you don’t do anything within five years, you will forfeit your contributions.

Your refund amount consists of your member contributions plus interest, compounded annually. Employer contributions remain with PERA to fund benefits provided by the association.

If you are employed in other Minnesota public service, such as a state or teaching job, your contributions can remain with PERA for a potential future Combined Service Annuity. Please keep your information up-to-date with PERA.

…I Become Disabled?

Benefits differ based on your plan. Check out your plan’s handbook or call us with any questions.

…I Get Divorced?

The PERA pension is a marital asset and could be subject to division in the event of a divorce. See the divorce page for more information or call us to get benefit estimates.

…I Take a Leave?

Military, personal and medical leaves can affect your pension benefit.

REGISTER FOR myPERA

Click the myPERA Login button in the upper-right corner of the screen

Select the Register As New User option

Enter your Social Security number, last name, date of birth, zip code, and PERA ID to activate your account

Can't find your PERA ID?

This number can be found on your welcome letter, or by clicking the “Request PERA ID No.” button and this number will be mailed to you. For private data and security purposes, we are unable to provide you this information over the phone.